Fixed manufacturing costs are regarded as period expenses along with SG&A costs. In some ways, this understates the true cost of production. The short answer is that the fixed manufacturing overhead is going to be incurred no matter how much is produced. In the long run, a business must recover those costs to survive.

7 Using Variable Costing to Make Decisions

These costs are subtracted from sales to produce the variable manufacturing margin. Some of Nepal’s SG&A costs also vary with sales. As a result, these amounts must also be subtracted to arrive at the true contribution margin. Management must take into account all variable costs (whether related to manufacturing or SG&A) in making critical decisions. From the contribution margin are subtracted both fixed factory overhead and fixed SG&A costs. Another advantage of using variable costing internally is that it prevents managers from increasing production solely for the purpose of inflating profit.

Cost Accounting Insights

Now assume that 8,000 units are sold and 2,000 are still in finished goods inventory at the end of the year. The amount of the fixed overhead paid by the company is not totally expensed, because the number of units in ending inventory has increased. Eventually, the fixed overhead cost will be expensed when the inventory is sold in the next period. Figure 6.13 shows the cost to produce the 8,000 units of inventory that became cost of goods sold and the 2,000 units that remain in ending inventory. The preceding illustration highlights a common problem faced by many businesses.

Breaking Down the Income Statement

With absorption costing, gross profit is derived by subtracting cost of goods sold from sales. Cost of goods sold includes direct materials, direct labor, and variable and allocated fixed manufacturing overhead. From gross profit, variable and fixed selling, general, and administrative costs are subtracted to arrive at net income.

They want to make sure they’re getting their fair share of taxes. Any financial statement must accurately reflect all of the company’s assets, expenses, liabilities and other financial asset turnover ratio explanation formula example and interpretation commitments. Reports must therefore be thorough and clear, without any omissions or modifications. When compiling reports, accountants must assume a business will continue to operate.

What is Standard Costing?

As shown in Figure 6.8, the only difference between absorption costing and variable costing is in the treatment of fixed manufacturing overhead costs. For example, if a fixed cost of \(\$1,000\) is allocated to \(500\) units, the cost is \(\$2\) per unit. But if there are \(2,000\) units, the per-unit cost is \(\$0.50\).

Accurate and effective costing is essential for achieving financial stability and long-term success in a dynamic business landscape. Your financial statements wouldn’t show the full picture. Absorption costing is your go-to for external reports. It factors in all manufacturing costs, including fixed overhead.

Each is being produced in equal proportion, and the company is fully able to meet customer demand from existing capacity (i.e., producing more will not increase sales). The company is not incurring any variable costs relating to selling, general, and administration efforts. By understanding absorption costing, businesses can better assess their product costs and profitability, ensuring that all manufacturing expenses are appropriately captured in their financial statements.

- With absorption costing, fixed manufacturing overhead costs are fully expensed because all units produced are sold (there is no ending inventory).

- Office rent, software licenses, senior staff salaries.

- For now, assume that Nepal sells all that it produces, resulting in no beginning or ending inventory.

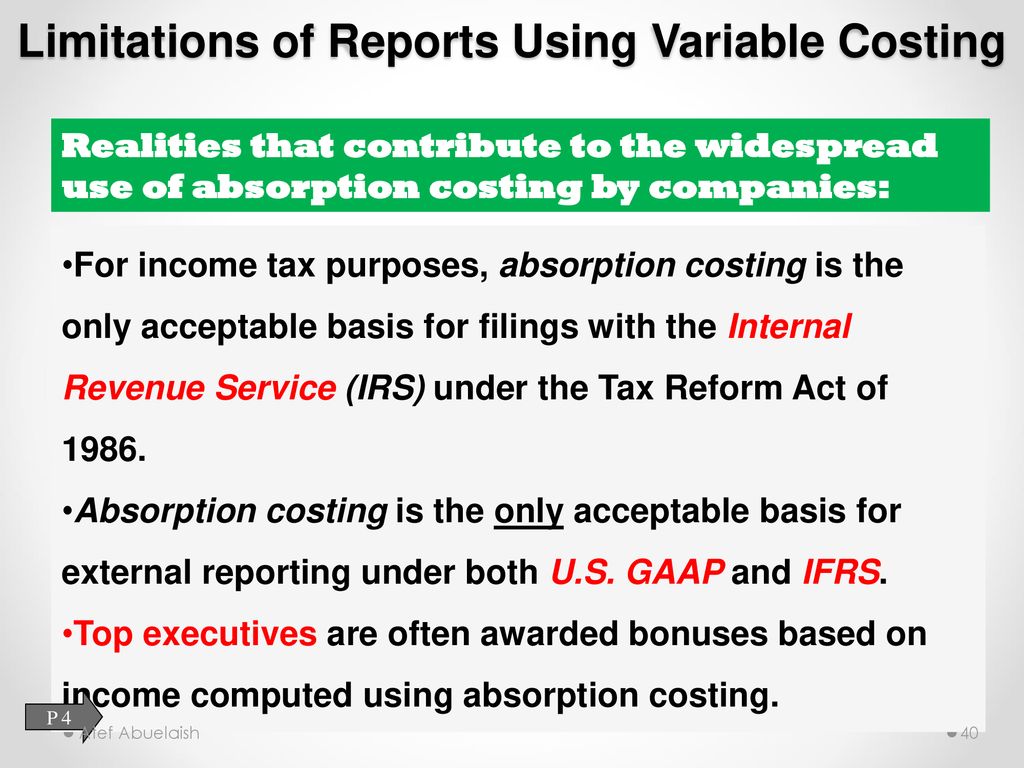

By adhering to GAAP, companies can ensure that their financial statements reflect a true and fair view of their financial performance and position. Variable costing provides managers with the information necessary to prepare a contribution margin income statement, which leads to more effective cost-volume-profit (CVP) analysis. By separating variable and fixed costs, managers are able to determine contribution margin ratios, break-even points, and target profit points, and to perform sensitivity analysis. Conversely, absorption costing meets the requirements of U.S. GAAP, but is not as useful for internal decision-making purposes.

It’s like having neat little boxes for everything. It gives a full picture of what it costs to make your stuff.