Capital a secondary leasing family demands a list of expenses, for example month-to-month home loan repayments, taxation, insurance coverage, and you will bills having repairs, tools, and you may management . Before committing to a home , it’s must know these types of can cost you and decide whether it is an effective feasible package.

In this post, you will see on what vacation leasing loan providers discover, different varieties of financing, and home loan cost. With this information, you’ll manage your trips rental financial support as opposed to feeling overloaded or unaware.

What’s a secondary Rental Financial?

Quite simply, a vacation leasing mortgage are that loan away from a financial (otherwise a lender) to help you finance your house. Besides could you be likely to spend it cash back, but you’ll must also spend mortgage loan.

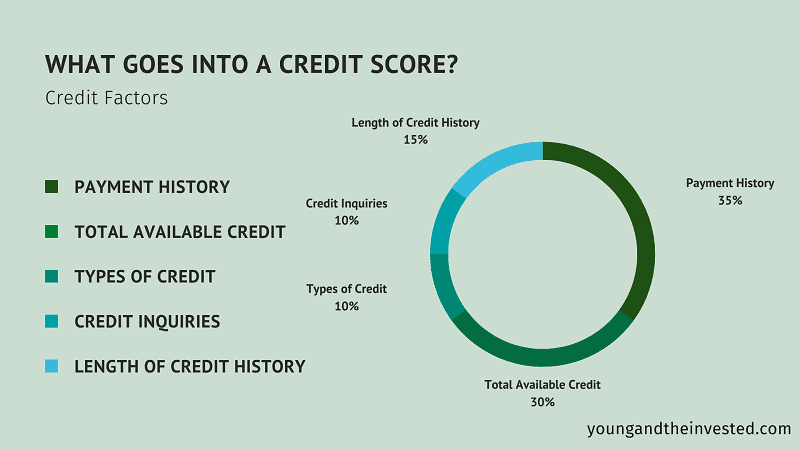

Local rental possessions financial pricing are at least 0.50% higher than number 1 homes. So it rates depends on the kind of property, the downpayment, along with your credit history.

Trick Approaches for Vacation Leasing Possessions Financial support

As mentioned, resource a secondary local rental is not necessarily the just like resource their fundamental house (if you don’t your own escape domestic!). Let me reveal an introduction to our ten fundamental tips:

step 1. Get ready an obvious analysis

- Why are your investing in a rental assets? Will be your main goal to make money otherwise how would you like a house one caters to your welfare?

- What sort of possessions do you enjoy?

- Where could you anticipate investing?

2. Research the market

In advance of jumping into the one thing, it’s also wise to would comprehensive browse of field. Discuss your options by calculating the cash-generating possible of different metropolises and you may features and you may monitoring their trick metrics . Throughout the mediocre cost of home and you will seasonality so you’re able to occupancy proportions and average everyday prices , it is essential to know-all the factors that may apply at your investment.

step 3. Realize about travel rental lending

Being qualified for a couple of mortgage loans actually something which everyone can perform or manage. However, understanding the various type of funds is an essential part regarding money your rental. Listed below are the new finance you could sign up for:

- Private currency fund: As mentioned within its term, an exclusive home loan originates from your own supply of currency. This might be other buyers, family, otherwise family unit members you are sure that that would be willing to subsidize the travel rental capital.

- 401(K) loans: These types of capital allows you to borrow cash from your own personal retirement savings account. This really is a good option when you yourself have a great safe matter stored within their 401(K) and for some body at a distance out of senior years. You might sign up for around 50% of one’s discounts based on your bundle. You’ll have to pay attention toward everything you withdraw, nevertheless count extends back in the 401(K) account, as opposed to a vintage financing where the appeal goes to the lender.

- Conventional financing: If you’ve currently been through a traditional mortgage channel to suit your first family, next this won’t getting some thing the new. An element of the standards are a great credit score and you can good 20% downpayment. The sole most foundation they are going to assess is if you are able to afford the first financial and an additional that. They are the most commonly known money for vacation rentals.

- Commercial loan to own accommodations: This is an excellent selection for those people seeking purchase a world multiple-device vacation rentals such as for example a bed and you may break fast , private villas , or a lodge . It truly does work much like a routine fees mortgage but is usually asset-established to safeguard the lending company regarding a default to your financing.

Guidelines and you will guidance having lenders regarding U.S. are ready set up of the Federal national mortgage association and Freddie Mac computer , a few bodies-sponsored enterprises guilty of increasing this new secondary mortgage market by the securitizing fund when it comes to home loan-backed bonds (MBS). The U.S. Congress created these types of mortgage businesses to help help the industry right back on 1990’s as they are today managed by FHFA.