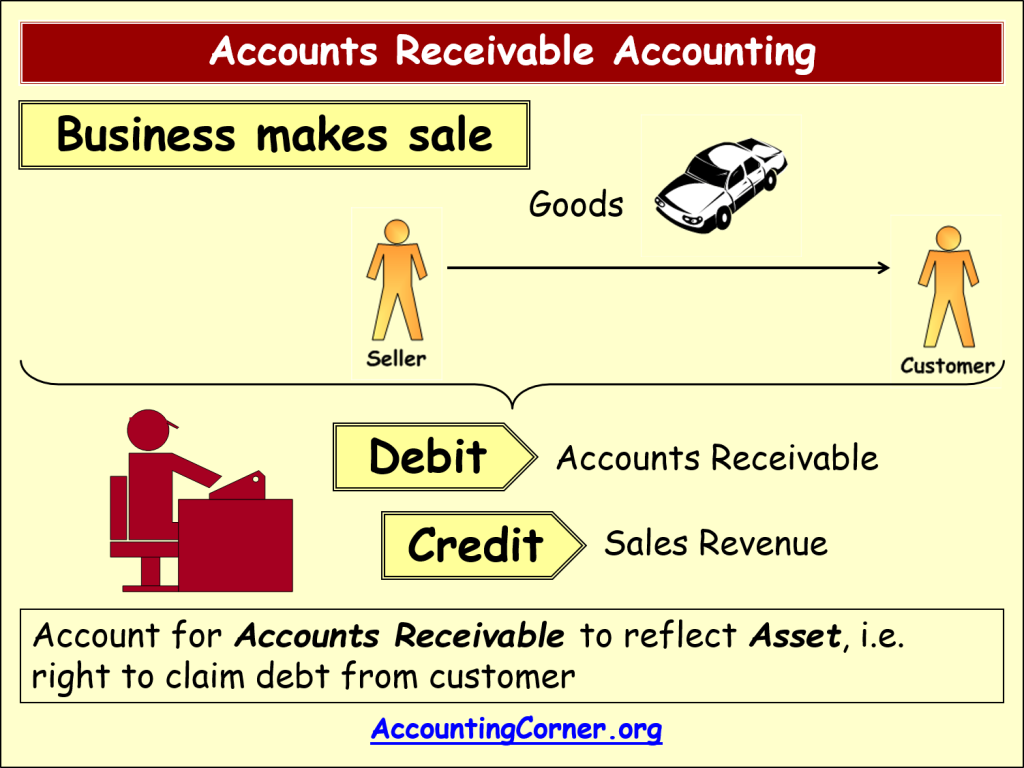

Now, you record the money that your customers owe to you as accounts receivable in your books of accounts, which are one of the important current assets of your business. The goal is to increase the numerator (credit sales), while minimising the denominator (accounts receivable). In an ideal situation, a business can increase credit sales to customers who pay faster, on average. Accounts receivable (A/R) or receivables are the amounts customers owe to the company for the goods delivered or services provided. Likewise, the company makes the journal entry for accounts receivable to recognize the assets that it has a claim as well as to recognize the revenue that it has earned for the period. That is, they deliver the goods and services immediately, send an invoice, then get paid a few weeks later.

Great! The Financial Professional Will Get Back To You Soon.

In such a case, Ace Paper Mill would either reach out to Lewis Publishers for payment or hire a collection agency to collect the accounts receivable. So, the allowance for doubtful accounts helps you to understand how much amount you need to collect from your debtors. In other words, the credit balance in the allowance for doubtful accounts tells you the amount that is to be collected from your credit customers.

When Cash Is Received For Goods Sold On Credit

The allowance for doubtful accounts is also recorded as a contra account with accounts receivable on your company’s balance sheet. Now, until the time when Ace Paper Mill receives the payment of $200,000, it will record $200,000 as Accounts Receivable in its books of accounts. Thus, both accounts receivable and sales account would increase by $200,000.

Accounts Receivable

- Through accounting software, you can invoice customers, send automatic payment reminders, create and view accounts receivable aging reports, and so much more.

- Accordingly, net realizable value of accounts receivable is a measure of valuing the accounts receivables of your business.

- Since, receivables are highly liquid assets that are expected to be converted into cash with one year, they are reported in the current assets section of the balance sheet at the end of each period.

- There are a variety of commonly accepted payments for small businesses, including e-transfer, ACH, credit, debit, check, and online payments.

- Before deciding whether or not to hire a collector, contact the customer and give them one last chance to make their payment.

Companies record AR journal entries when a credit sale is made, a customer pays off his balance, or a bad debt is written off. For many retail firms, accounts receivable represents a substantial portion of their current assets. On the other hand, if a company’s A/R balance declines, the invoices billed to customers that paid on credit were completed and the money was received in cash. The days sales outstanding (DSO) measures the number of days on average it takes for a company to collect cash from customers that paid on credit. Whether cash payment was received or not, revenue is still recognized on the income statement and the amount to be paid by the customer can be found on the accounts receivable line item.

How accounts receivable automation software can help improve your A/R workflow

From June 1 until the company receives the money, the company will have an account receivable (and the customer will have an account payable). Let’s look at how accounts receivable is recorded and reported on the financial statements. The balance of money due to a business for goods or services provided or used but not yet paid for by customers is known as Accounts Receivable. These are goods and services delivered by a business on credit to their customer with an understanding that payment will come at a later date. The primary sources of receivables are transactions with customers in which they are allowed to pay later. The forecasted accounts receivable balance is equal to the days sales outstanding (DSO) assumption divided by 365 days, multiplied by 365 days.

Our Services

Intuit does not endorse or approve these products and services, or the opinions of these corporations or organizations or individuals. Intuit accepts no responsibility for the accuracy, legality, or content on these sites. Accounts payable tells you exactly which suppliers you owe money to, and how much. Get free guides, articles, tools and calculators to help you navigate the financial side of your business with ease.

If you don’t already charge a late fee for past due payments, it may be time to consider adding one. For comparison, in the fourth quarter of 2021 Apple Inc. had a turnover ratio of 13.2. But if some of them pay late or not at all, they might be hurting your business.

Companies record accounts receivable as assets on their balance sheets because the customer has a legal obligation to pay the debt and the company has a reasonable expectation of collecting it. They are considered liquid assets because they can be used as collateral to secure a loan to help the company meet its short-term obligations. The accounts receivable turnover is a ratio that measures the number of times your business collects its average accounts receivable over a specific period. Accounts receivable turnover measures how efficiently your business collects revenues from customers to whom goods are sold on credit. The customers to whom you sell goods or services on credit are recorded as trade debtors or accounts receivable in your books of accounts. That is, you record accounts receivable in general ledger accounts under the account titled ‘Accounts Receivable’ or ‘Trade Debtors’.

Accounts payable on the other hand are a liability account, representing money that you owe another business. For example, you can immediately see that Keith’s Furniture Inc. is having problems paying second stimulus bill its bills on time. You might want to give them a call and talk to them about getting their payments back on track. Good cash reconciliation can also improve a business’s customer relations.

CEI is an important metric for demonstrating that a business can maintain a seamless cash flow process. It also indicates that your customer credit assessment is effective since you have a high ratio of paid invoices to total invoices. If a company offers customers a discount if they pay early and they take advantage of the offer, then they will pay an amount less than the invoice total. The accountant needs to eliminate this residual balance by charging it to the sales discounts account, which will appear in the income statement as a profit reduction.

For one, it can help you optimize your cash flow and increase your working capital. Automating your accounts receivable can also help reduce the administrative burden of managing it, such as sending automated reminders, invoicing, and tracking payments. A Collections Efficiency Indicator (CEI) relates the number of successfully collected debts to the number of total debts. A high CEI rating indicates that a business’s Accounts Receivable process is effective in collecting customer payments.