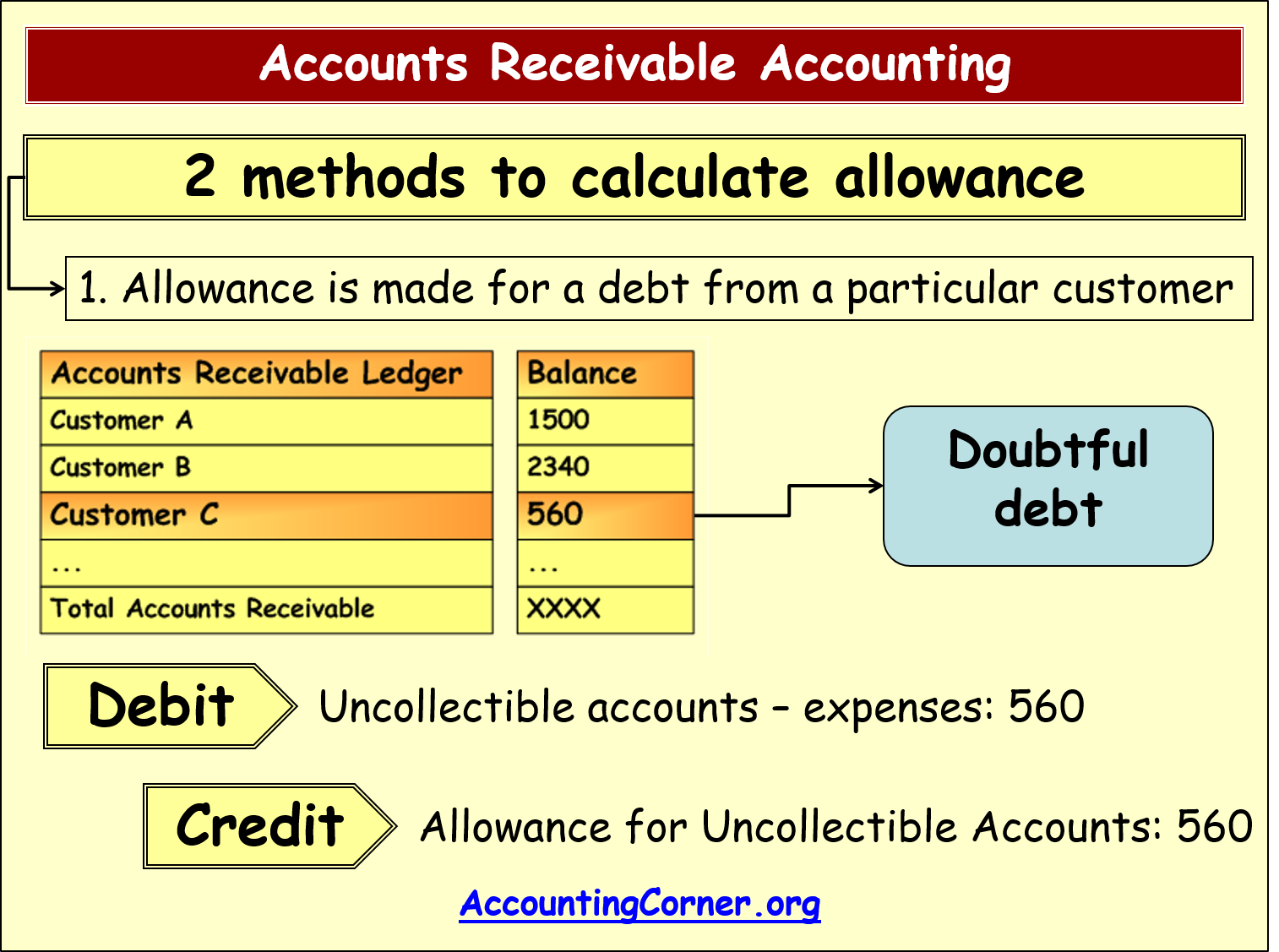

After assessing the goods, XYZ Co. returned products worth $50,000 as they suffered damages during the delivery. ABC Co. compensated XYZ Co. for the returns by reducing its accounts receivable balance. Then, the allowance the customer receives is credited to the company’s accounts receivable.

Classification and Presentation of Sales Returns and Allowances

This ensures that the financial statements accurately reflect the net sales and provide a true picture of the company’s revenue. Failure to do so can lead to misstated financial results, which can mislead stakeholders and affect business decisions. A contra-revenue account is a liability from revenue which helps in determining whether to omit certain sales transactions, which would otherwise be mistaken as revenue. It is usually included if there are any sales returns and allowances or other type of return not recorded in the sales journal.

The HubSpot Customer Platform

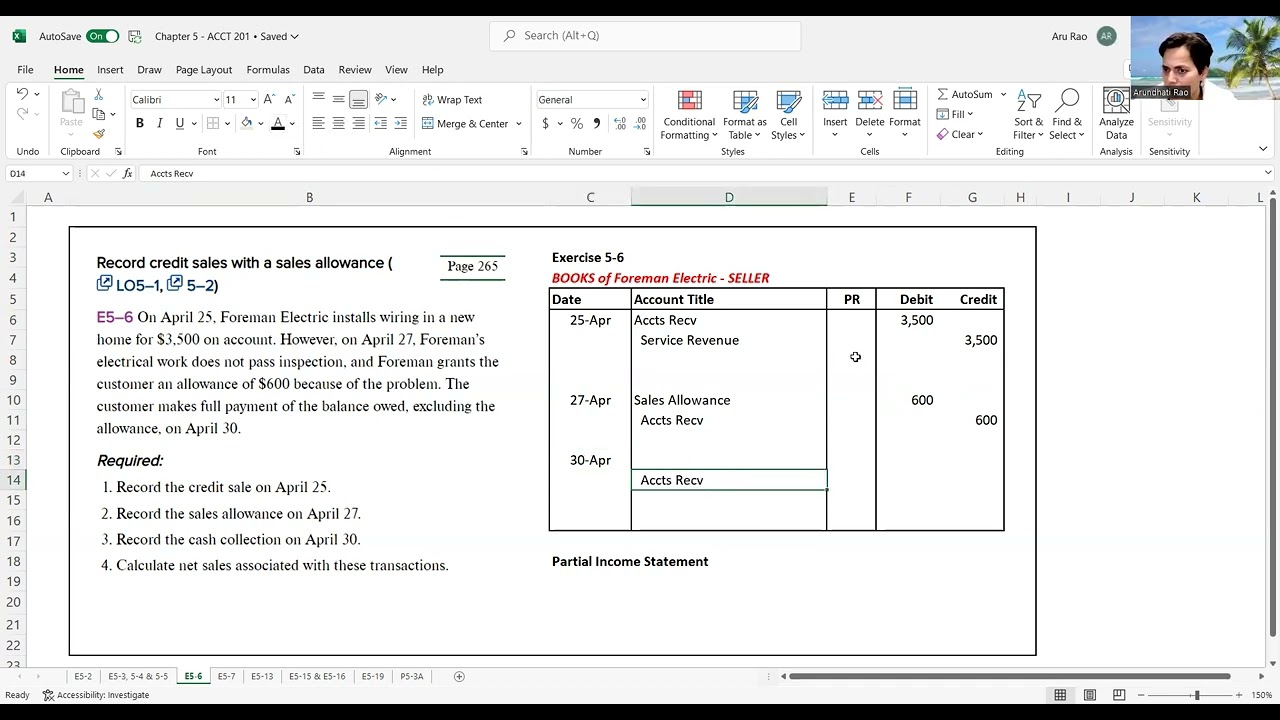

Once the credit memo is issued, the next step involves updating the accounting records. This typically requires making a journal entry that debits the sales allowances account and credits accounts receivable. By doing so, the company effectively reduces its reported revenue and adjusts the amount owed by the customer.

What is a contra-revenue account?

You want to make sure you’re taking all of these costs into consideration. It’s not a good idea to leave this out as it could affect your overall allowance price and cause you to lose money. It gives you additional opportunities when shopping with customers while helping increase their overall satisfaction with doing business with your company.

An allowance occurs when a buyer decides to keep damaged or defective goods but at a reduction from the original price. During the same period, ABC Co. made sales of $200,000 to another customer, RST Co. The accounting entries to record revenues from the transaction were as follows. Accounting for a sales allowance is fundamentally similar to accounting for a sales return. The amount recorded as sales allowance is the amount of reduction in the original sales price. There are different ways to determine this, such as having your employees inspect products before putting them into inventory.

- Further, the allowance helps the seller save on returning costs, a full refund, legal issues, or a dent in its brand reputation.

- The result of the pairing of the gross sales and sales allowance accounts is net sales.

- This was done as part of their annual inventory reduction plan, which occurred from October through December each year.

This proactive approach enables companies to minimize future allowances, thereby improving profitability and customer satisfaction. If the return or allowance involves a refund of the customer’s payment, “Cash” is credited. Or, a payable account is credited if the refund is to be made at a future date. UrbanStyles,” aiming to maintain a positive relationship with the customer, decided to offer a sales allowance. The credit part of this entry involves both a controlling account (accounts receivable) in the general ledger and a customer’s account (Champ’s TV Sales) in the accounts receivable subsidiary ledger.

All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. For instance, if a buyer were to purchase the aforementioned hard-boiled egg machine and notice only five out of its six egg-cooking modules are operational, they might ask for an allowance.

Like debit memos, all credit memos are serially numbered, as shown below. ABC Co. offered the company a $30,000 software for accountants and bookkeepers, which the customer accepted. Therefore, the journal entries for sales allowances provided to RST Co. are as follows.